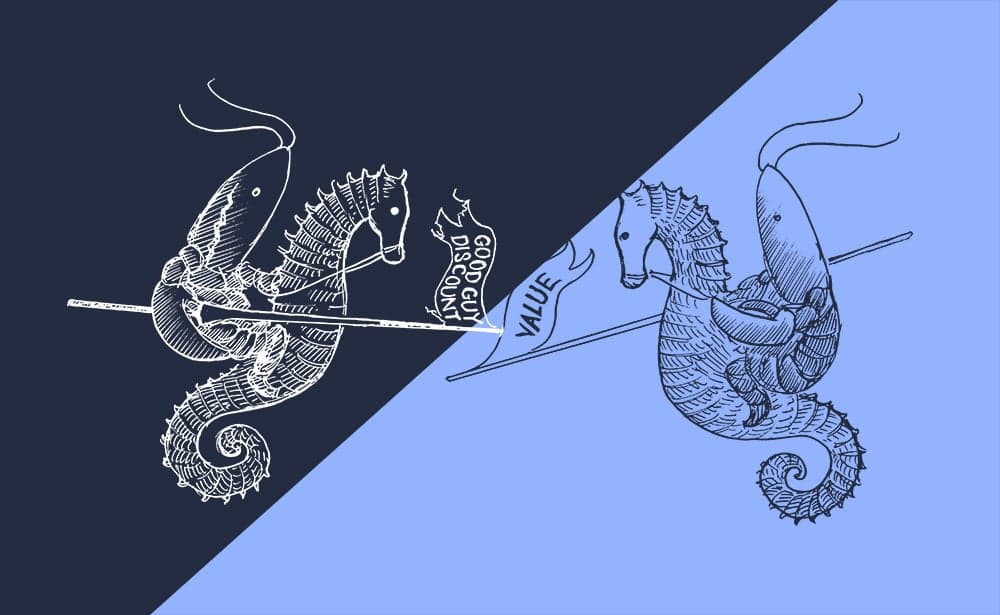

“Do you have a good guy discount?” asked my traveling partner of the rental car agent when we landed in Portsmouth, N.H.

I looked incredulously over at the rental car counter as I watched a negotiation ensue over “the good guy discount.” Unsatisfied with the level of discount offered, this same exchange continued at the next counter and then another, until finally the right amount of “good guy discount” was applied to the rental.

“Why did you press for a nonexistent discount,” I asked after the transaction was done having distanced myself far away from the counter, too embarrassed to be associated with someone who felt the need to negotiate the advertised fee — loudly and proudly. “Because I could,” was the answer I received. “If you don’t ask, you pay too much.”

So what made these cars not worth the advertised rental fee? Why did my partner feel the need to haggle? Was the value of the car not in alignment with the payment? Clearly, we needed a car, having landed without any means of getting on the road to our destination. So the value of a car to drive several hundred miles more that week was very real — hitchhiking was out of the question. However, the supply of rental cars that day was great, the demand — just us walking from counter to counter to haggle — was slim. The “good guy” leveraged this into a discount.

This story is one I tell often — me from the school of Saturn (remember Saturn cars?) no-haggle pricing and my traveling partner from the school of “I always deserve a discount.” In our businesses, we often discuss pricing strategies — tiers, competitors, anchoring, etc. But what about discounting and its relationship to value?

How do you determine value when it’s not only a supply-and-demand proposition — it’s also an intangible emotion. How do you price the value of an emotion?

Formally known as value-based pricing strategy and measured with the KPI “price-to-value ratio,” value isn’t a new concept in pricing strategy. Value-based pricing doesn’t rely on simple cost inputs and profit outputs. Instead, this is a strategy that sets prices based on a consumer's perceived value of the product or service. Simply, companies base their pricing on how much the customer believes a product is worth.

There are many upsides to this pricing strategy in an ideal situation, but it can also spell disaster when faced with a disillusioned discounter. Let's dive in.

Lobsters: A Circular Pricing Story

Lobsters were not always the prized dinner they are today. When the English settlers first wrote back about their experiences in the New World, they talked about the bounty of the harvest … and the “cockroaches of the sea.” Yes, that lobster roll you covet today was once considered such a nuisance, they were ranked with lowly cockroaches. However, because they were so plentiful, whenever there was a bad harvest season the lobster provided an always available protein. This elevated the lobster from cockroach status to modern day ramen status.

Things remained the same for the lobster, serving as a meal for the poor until the mid-1800s and the dawn of rail transportation and canned food preparation. Until this point, the lobster was only available in coastal locations. Canning and tourism exposed the lobster to new audiences further inland. Intrigued by this cockroach of the sea, tourists were now experiencing “New England” foods via rail — and lobster prices climbed as the popularity and novelty of fresh lobster rose. The cost of lobster “production” didn’t change, but the customer perception of lobster did — an association of value was applied to the lobster. New England restaurants leveraged the customer's perceived value of this experience to raise prices.

By World War II, the lobster had become a delicacy. Lobster wasn’t rationed and wealthier families continued to consume the shellfish at higher rates. In fact, this sea cockroach has been fished to a point where catches are routinely at their lowest levels matching low demand; however, pricing remains high. Interestingly, the perceived value of lobster not only determines price, but the supply and demand for lobster also plays a role in elevating lobster prices, bringing us full circle in the pricing story of the lobster.

Value Pricing To Increase Profits

What can we learn from the lobster and apply to pricing strategy? If you can achieve changing the perception of the value of what you provide to your customers through your product or service, you can essentially remove the constraints of traditional pricing inputs.

The lobster is a perfect example — high supply didn’t hold back pricing once restaurants in the 1800s began to package the lobster not as simple protein but instead as an authentic New England experience that you simply couldn’t get anywhere else. The lobster supply remained plentiful during that time, the cost to harvest the lobster didn’t change, and yes, there is competitive pricing in play, but that isn’t the driver of what you are willing to pay for the perfect buttery lobster salad on a crisp lightly toasted bun. Yes, lobster tastes good wherever you are, but never as good as when you are consuming it near soft sea breezes. It's the experience you are looking for and the memory you are paying for. The value of that memory doesn’t have a price ceiling.

Because of value-based pricing, once achieved, you can break through a competition-based pricing ceiling. Even better, if your customers are willing to pay more for the relationship they have with you over a transactional relationship with someone else, you can leverage this scenario to bring your customers into a continual improvement process with your company, seeking to increase the value perception they have with your company while simultaneously improving your product or service.

“Discounting isn’t a pricing strategy — it’s admission of guilt.”

Value-based Pricing Implementation

Implementing value-based pricing requires a solid understanding of your customer community and communication systems. Implementing a value-based strategy requires a system to monitor customer feedback beyond the net promoter score. Establishing, monitoring, and measuring customer sentiment is key.

Customer sentiment analysis can be as complex as AI or as simple as social listening. After considering your resources and the level of digitization at your organization, choose to implement one of the following recommended KPI combinations, which build on each other.

Digitization Level 1

- Net Promoter Score

- Reviews

- Social Listening Overall Comment Velocity

These foundational KPIs may be found in other parts of your dashboard but are fundamental to understanding your customer’s perception of your brand. If you do not have these measurements in place, it will be difficult to implement value-based pricing strategies that are consistent.

Digitization Level 2

- Social Listening Brand Mentions

- Social Listening Brand Shares

- Social Listening Brand Reactions

Once you have a foundational understanding of your brand’s performance with customers, you can move into quantifying organic conversations about your brand through basic social listening strategies — namely how are your customers reacting to your own posts, are they sharing what you post, and do they organically mention your brand in their own posts. The more positive shares, mentions, and reactions, the higher your brand’s perceived value is.

Digitization Level 3

- Social Listening Brand Tone

- Social Listening Brand Context

- DM Conversational Tone

Now that you have a measurement of your brand in the wild, ultimately, you will need to add context to the conversation. Highly digitized brands can leverage AI to apply metrics that interpret tone and context around customer generated social conversations that are both public (tweets, comments, and posts) and private (bot, chat, or DMs through your social media channels and website assets). This is the holy grail of value-based pricing data — allowing you to quantify context and emotion by applying weighted score attributes. For example, a customer shares “just got my box from [your brand] today” vs. “just got my box from [your brand] today — I love it!” The mention of the word “love” would be weighed with a higher score than just the brand mention itself, which is a neutral value.

These KPIs not only allow your company to break from the constraints of supply/demand, cost-plus, and competitor-based pricing, but they also influence the foundation of your brand, ultimately pushing your company to be more customer-centric.

Value: Real vs. Fake News

Value-based pricing is wonderful when you have happy customers who perceive your product or service as special. What can you do when the good guy discounter seeks to lower your price?

Denying the “Good Guy Discount”

Every sector of the market has its “good guy discount” hunters who firmly believe that this is simply how things work — and unabashedly ask for discounts because, well, to quote my travel partner, “why not?”

First, it's important to understand that this could be part of someone’s culture. Immediately a Middle Eastern market bazaar comes to mind. But the modern market is Google and the town square is now the 1st page of search results. Just as our “good guy” has a right to ask for a discount, your business doesn’t have to feel compelled to give it.

Consider this: the higher the perceived value, the less likely you are to discount. Discounting isn’t a pricing strategy — it’s admission of guilt. By discounting, you are communicating to the world no matter if you believe it or not, that you don’t believe your product is worth the value you have asked for it. Discounting is a crack in your brand armor. And once there, it's impossible to reestablish value with your customer. They know that a crack exists and will pounce on the fault line until you break.

These discounters are not loyal to your brand and see you as a commodity. Value-based pricing and discounting can not exist together.

Discounting is a crack in your brand armor. And once there, it's impossible to reestablish value with your customer.

Discounting vs. Sales

Discounts spell death to a brand, however, there are other pricing strategies that your business can leverage to reward its customers or clear out aging inventory. Is the price lower than usual — yes. Is it a discount — no. The optics and presentation of a sale or customer reward is not a discount.

Consider sales as a position of exclusivity: they only happen rarely or position a few remaining items as special. Nordstrom positions their sale as a once-a-year anniversary event. Amazon leverages “Prime Day” as their own version of a mid-year digital Black Friday. These events are so special that they make the regular news cycle, and blogs and insider tips publish days before. This year Amazon’s delayed Prime Day didn’t disappoint. Third-party sellers — most of which are small- and medium-sized businesses — surpassed $3.5 billion in sales on Prime Day — a nearly 60% year-over-year increase, growing even more than Amazon’s retail business.

Sales can also be positioned considering rewards customers instead of discounts. Early access to regular sale events like Amazon’s Prime Member early access to Prime Day deals or added savings for loyal customers or store card holders add value — unlike the good guy discount.

When you position your discounting strategy as a sale or customer benefit, your brand takes control of the timing of pricing conversation — unlike our good guy who asks for a discount no matter the circumstance. Brands that leverage control over timing don’t fall prey to devaluing their brand by employing strategic reasoning and timing to their pricing strategy.

Value pricing is an emotional valuation of your company’s impact on the customer. When done well, your company can break free of traditional market pricing constraints and transcend categorization from a sea cockroach to a delicacy. Done poorly, and you find yourself in a pot of boiling water. And next time you find your business confronted with the good guy discounter — let him get his lobster roll at the next stand.

Illustrations by John Gummere